In today's ever-changing economic landscape, protecting your business from the uncertainties of a recession is crucial.

We've gathered insights from ten experienced business leaders who have not only survived but thrived during challenging economic times.

In this article, you'll discover practical money-saving tips that can help you strengthen your business and ensure its resilience in any economic climate.

Whether you're a seasoned entrepreneur or just starting, these strategies, born from years of experience, will provide valuable guidance to safeguard your business and position it for success.

|

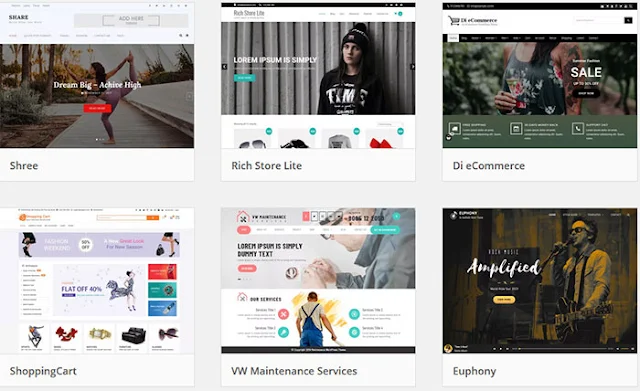

| 10 Experts Give Their Money-Saving Tips for Recession Proofing Your Business: eAskme |

If you're eager to recession-proof your business, read on as these industry experts share their proven tactics.

1. Review Software Subscriptions and Consider Open-Source:

In an age where technology plays a pivotal role in business operations, Phil Norton, Founder of Leave Dates, a staff holiday tracker for small businesses, emphasizes the importance of scrutinizing software subscriptions to reduce unnecessary costs.

He wisely suggests, "Reviewing your software subscriptions can be a quick way to reduce costs. Work out what functionalities you need, and whether you're currently paying for things you don't need." Phil's insight highlights the need to assess whether you are getting value for money from your software tools.

Businesses often find themselves with comprehensive software packages with features they seldom use. By thoroughly evaluating your software needs, you can downsize to more cost-effective solutions that align with your essential functionalities. As Phil Norton puts it, "Why pay for more?"

James Jason, Co-founder and CEO of Notta AI goes a step further: "one of the most effective ways we have been able to do this is by utilising open-source software instead of proprietary solutions.

Open-source software is free to use and can be modified to fit our specific needs."

James's advice underscores the potential cost savings that open-source software can bring to your business.

Consider leveraging free and customizable open-source alternatives instead of investing in expensive software licenses. This approach allows you to tailor software to your precise requirements without compromising quality or functionality.

2. Flexible Scheduling to Reduce Overtime Costs:

James Jason further shares another valuable tip on cost savings within the workplace. He mentions, "Another way we have saved money is by implementing flexible scheduling to reduce overtime costs. Our employees are free to choose their schedules, which allows us to reduce overtime costs."

This approach reduces the financial burden of overtime pay and enhances employee satisfaction and productivity.

Employees who have control over their schedules are often more engaged and efficient, contributing positively to the business's overall performance.

Another option could be to offer time off in lieu to staff for overtime work rather than extra pay.

3. Rent Equipment Instead of Purchasing:

Michael Chen, Chief Product Director at Airgram, advocates renting equipment as a savvy money-saving strategy.

He explains, "Renting equipment instead of purchasing is another way we have saved money. Instead of buying expensive equipment that we may only need occasionally, we rent equipment as needed."

Renting equipment offers financial flexibility, especially for tools that are not in constant use. It eliminates the upfront costs of purchasing and the long-term maintenance expenses associated with ownership.

Additionally, it enables businesses to access the latest technology without the capital investment of purchasing new equipment.

4. Promote Remote Work:

Michael Chen highlights its cost-saving potential in a world increasingly embracing remote work.

He notes, "We have encouraged telecommuting and remote work to save money. Our team can work from home or a remote location, which has helped us to reduce our overhead costs."

Remote work reduces office space, utilities, and office supplies expenses. It also allows businesses to tap into a wider talent pool, potentially reducing labor costs while maintaining or even enhancing productivity. Embracing remote work can be a win-win solution for both employers and employees.

5. Reduce Paper Usage and Embrace Automation:

Johell Aponte, Founder & CEO of Move On House Buyers, offers multifaceted money-saving strategies.

He suggests, "Reducing the use of paper in the workplace can save money on printing, storage, and shipping costs. This can include going paperless whenever possible, such as sending emails instead of printing memos or using digital tools to take notes."

Johell's advice emphasizes the importance of digitization and automation in modern business operations. Reducing paper usage reduces costs, streamlines workflows, enhances efficiency, and is better for the environment. Embracing technology-driven solutions can lead to significant long-term savings.

Eric Jones, CEO of Couture Candy, also encourages reducing paper-related costs. He suggests, "Many companies still rely heavily on paper for documentation, which can be expensive in printing, storage, and shipping costs. Switching to digital documentation can save significant money in the long run."

Eric's advice resonates with the digital age, where information is readily accessible at our fingertips. By transitioning to digital documentation, businesses can reduce their reliance on physical paperwork, saving on printing and storage expenses while increasing accessibility and efficiency.

6. Embrace Energy-Saving Measures:

Dale Shadbegian, CEO of Cape & Plymouth Marketing, underscores the importance of energy-saving initiatives in reducing operational expenses.

He advises, "Implementing energy-saving measures such as turning off lights and equipment when not in use, using energy-efficient light bulbs, and using natural light can help save money on utility bills."

Dale's recommendation extends beyond cost savings. It aligns with the growing global focus on sustainability. Energy-efficient practices reduce expenses and contribute to a business's environmental responsibility, which can be an essential aspect of your brand image.

Jennifer Spinelli, Founder & CEO of Watson Buys, also emphasizes the importance of energy conservation within the workplace.

She recommends, "Strictly enforce policies related to energy usage such as turning off lights and equipment when not in use. This will help reduce electricity bills and reinforce an eco-friendly attitude in the office."

7. Outsource Non-Core Functions:

Eric Jones also highlights the benefits of outsourcing non-core functions to specialized service providers.

He notes, "Outsourcing non-core functions such as accounting, payroll, and IT can help save money and free up resources for core functions. This can be especially beneficial for small businesses that cannot afford to have in-house teams for every function."

Outsourcing allows businesses to tap into expertise without the overhead costs of maintaining in-house departments. It enables businesses to focus on their core competencies while entrusting specialized tasks to professionals, optimizing efficiency and cost-effectiveness.

8. Negotiate with Vendors:

Eric Jones recommends adopting a proactive approach to vendor relationships.

He suggests, "Negotiating with vendors for better pricing and payment terms can help save money. Companies can also explore alternate vendors and compare prices for the best deal."

Effective vendor management involves continuous evaluation and negotiation. By seeking favorable terms and exploring multiple vendor options, businesses can reduce procurement costs while maintaining the quality of products and services.

9. Reduce Office Space:

With the changing work landscape, Eric Jones suggests reevaluating office space requirements.

He advises, "With remote work becoming more common, reducing office space can save money on rent, utilities, and office supplies. Companies can also consider coworking spaces or shared office spaces as a more cost-effective option."

Reducing office space is not only a cost-saving measure but also aligns with the evolving work preferences of employees. It offers flexibility and significantly reduces overhead expenses while providing a dynamic and adaptable work environment.

10 Utilize Cloud Computing:

Eric Jones also underscores the benefits of cloud computing for cost-conscious businesses. He explains, "Cloud computing can significantly reduce the costs associated with buying, setting up, and maintaining expensive IT hardware and software for employees."

Cloud computing offers scalability, flexibility, and cost-effectiveness. It eliminates the need for extensive in-house IT infrastructure and provides access to cutting-edge software and services on a pay-as-you-go basis, reducing upfront capital expenditures.

11. Streamline Processes and Procedures:

Andrew Pickett, a Trial Attorney at Andrew Pickett Law, advocates for streamlining processes and procedures within your organization.

He advises, "Looking at existing systems and identifying areas that can be improved upon or are redundant can yield great cost-saving results without sacrificing quality."

Andrew's recommendation highlights the importance of continuous improvement and operational efficiency.

Businesses can optimize their processes, reduce costs, and enhance overall quality by identifying and eliminating redundancies and inefficiencies.

Conclusion:

In times of economic uncertainty, the wisdom of experienced business leaders can serve as a guiding light.

The insights these ten experts share offer diverse strategies to save money and recession-proof your business.

There are numerous avenues to explore, from software optimization and remote work to energy conservation and vendor negotiation.

Whether you're a small startup or a well-established corporation, the principles of cost-consciousness and efficiency apply universally.

By implementing these money-saving tips and adopting a proactive approach to financial management, you can navigate the challenges of a recession with resilience and confidence.

As you embark on your journey to recession-proof your business, remember the words of these industry luminaries.

Their collective wisdom provides a valuable roadmap to financial stability and long-term success.

So, take these insights to heart, adapt them to your specific circumstances, and chart a course toward a prosperous future for your business.

Still have any question, do share via comments.

Share this post with your friends and family.

Don't forget to like us FB and join the eAskme newsletter to stay tuned with us.

Author:

Phil Norton:

Phil is the co-founder of Leave Dates, the employee annual leave planner. He loves problem-solving and making life easier for small businesses. If you book a Leave Dates demo, he will give you a warm welcome and show you everything that you need to know.

Other handpicked guides for you;